What is it about shows like Fixer Upper that leave us glued to the TV and in awe of each renovated masterpiece? If you’re like us, maybe you’ve spent hours mesmerized by Chip and Joanna’s ability to see the potential in a seemingly helpless home. There’s something special about being able to envision the final product of the home while staring at its broken pieces. This exactly what Lucas, an architect and Design Director at Mike Shively Architecture, did with his second property. He makes a living helping create dream homes for others, but now it’s his turn. Follow along in this Behind the Buyer article, where we’ll get a look behind the scenes of Lucas’s very own fixer-upper. Whether you’re building, buying new, or completely renovating you’ll want to glean some wisdom from this architect!

Lucas and his partner Nick bought their first property several years ago, a condo located in Lincoln Park. The pair spent several years remodeling their condo before selling it with market conditions on the rise. The profit from their new and improved condo allowed them to take a step up on the property ladder, this time looking for a house to call their own. The vital role their real estate agents played during their homebuying experiences stood out to them.“I think having the right realtor is huge. We used our realtor both times we purchased property. He and his team were really great, extremely patient, especially the first time around. We looked for a long time because we what we wanted ended up changing the more places we saw. They were always very invested in our goals.”

If you’re thinking about buying a home soon, this is a message for you: Take the time to find the real estate agent who is best equipped to help you meet your needs. Lucas explains that finding the right real estate agent makes your life a whole lot easier.

House – Before and After

Homebuying veterans, Lucas and Nick had a clearer idea of what they wanted their second time around. “For our second property, we knew we wanted to buy a multi-unit building so we could generate some income from a tenant. After making some cosmetic renovations to our first condo, we knew we were ready to take on more of a project.” Lucas explained. The properties they examined varied widely on what the project could be. Some of the houses cost more and required less work. Other properties cost less but required more fixing up. Regardless, they knew that they wanted a house that they could fix-up and make their own.

Lucas and Nick met somewhere in the middle, finally landing on a home after falling in love with the neighborhood. However, Lucas admitted to not wanting to visit the property after seeing the listing online, “I did all the things you just shouldn’t do as a buyer, I judged it from pictures, but I’m glad we ended up looking at it because the neighborhood totally sold me.”

Future buyers, listen up! Don’t judge a book by its cover, in a similar manner, don’t judge a house by it’s listing! What you see may just surprise you!

Unlimited Potential

Attic turned master bedroom

Lucas and Nick’s new home, originally a duplex and simplex unit, was about to get an extreme makeover. What may have looked impossible to someone else, they saw unlimited potential. Seizing an opportunity to expand into the attic space they recreated their home into two duplex units: a three-bedroom, two-bath rental unit and a two-bedroom, two-and-a-half-bath for themselves.

During the entire renovation process, they lived in the rental unit while their’s was being updated. Lucas and Nick were busy painting, updating, and cosmetically fixing what would be their rental unit. The larger scope of the work was being done to their unit, which originally was a single-floor apartment. “We basically gutted the first-floor apartment down to the studs and did a lot of reframing because there were some structural issues with the house because of a renovation that happened in the early 90s. They made some strange choices structurally that we had to fix. For example, the floor was sloped about 2 inches so if you overflowed your cup of water and set it down on a table it might spill,” Lucas laughed.

In addition, all of the plumbing, mechanical, and electrical work was completely new. They even added a staircase up to the attic, now their master bedroom. But perhaps the most substantial change of all was the reconstruction of the back porch. Lucas explained, “In Chicago, we have these enclosed back porches. I think at some point people kind of threw some plywood up there to enclose them. So, we tore that three-story porch off and built a new exterior porch, which allowed a lot more light into the building, because you basically have the front and the back of the house to get light in and the back was blocked by the enclosed porch. We also put a big sliding door out to our porch which put a ton light into our kitchen.”

Enclosed porch vs. new & improved addition

Even though so many good changes were made during their renovation process, it definitely was not smooth sailing. The renovation took almost a year for all of the major projects, but it could have taken less than that. Choosing the wrong contractor led them to their biggest pain point of buying their home. Lucas clarified, “We chose that contractor because they were the least expensive. Budget was a huge concern and we looked into some references, but they weren’t necessarily the scale of project that our project was. In the end, they ended up walking away from the project at a really inopportune time after they had drug out the process for quite some time. We had to kind of pick up the pieces, make sense of what money was leftover.”

Make sure you do your homework when it comes to hiring a contractor! Dive deeper to ensure that they are qualified and capable to deliver. Lucas stated that budgeting was a concern causing them to decide on a cheaper contractor who probably ended up costing them more money in the long run. You may decide to readjust your budget to pay more for a quality job and then tighten up in other areas.

Budgeting — This or That?

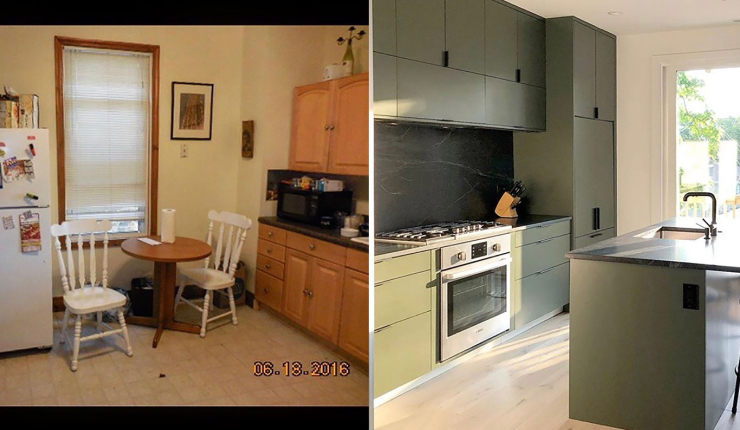

Budgeting may indeed be one of the most difficult parts of the homebuying process. When it’s your first time buying a home, it’s especially hard to know how to budget. Lucas offers several insights that may just help you! First, separate needs and wants. “For our kitchen, we were willing to splurge for a stone slab backsplash vs. just doing tile. It was a high-end move but is our favorite thing about our kitchen.” Lucas and Nick knew that a stone slab backsplash was very high up on their priority list, so they were willing to spend more money on it and then spend less on other areas to compensate.

Stone slab backsplash

Kitchen before and after

Another tip from Lucas is to set a realistic budget. Lucas explained that having a professional opinion from an architect or designer can help you make sense of where to save and where to splurge. Having a clear idea of what you’re willing to spend more on and where you can cut back will help create a budget that is effective for you.

Lucas also spreads some practical advice when it comes to saving money. He reveals, “When we were initially saving to buy our first place, we set a budget goal for each month. We made a separate account from our regular savings account that was specifically for our first property. We had automatic drafts from our paycheck, so the day we got paid some of that paycheck went directly into our account. It took staying disciplined, but we vowed not to touch that money. And any extra money we got, for example, a bonus from work, we would put directly into that.”

Equally important to staying disciplined is taking advantage of any government loans you may qualify for. “On our first property, which was a foreclosure, we were able to use an FHA loan which allowed us to put 5% down. That was really nice because we could put 5% down and then use some of the savings we had for the initial investment to make some improvements on the condo right away.” For their current home, they used the money they made from their condo to put 20% down, which meant no PMI or additional fees. In turn, this allowed them to take out a conventional construction loan for their renovation process. “With that, we were able to fully gut our unit, reclad the exterior, replace the porch, get all new mechanicals, electricals, a new roof… all that kind of stuff.” Lucas illustrates. We recommend looking into all government housing and construction loans to see what you may qualify for. You never know, it could end up saving you some money!

Fix-it-up or leave-it-be?

Added skylights for natural lighting

If you’re not Chip and Joanna Gaines gut renovations can be downright intimidating! You may feel like you have no idea what you’re doing and it’s hard to envision an end product. However, Lucas sheds some light on the remodeling process. “I understand that this may be a little self-serving because I am in architect, but I think it’s really important to hire a designer or an architect if you’re thinking about making substantial changes to the property. We are trained to look at something and see the potential, to see beyond the basic changes, and to create value out of something you may not see at first.”

Butler’s pantry/Coffee bar (Former bathroom with a tub where counter is now)

He goes on to explain that they were able to make some structural changes that maximized their space and created even more value for the home. “For example, we were able to take what would’ve been a very large bathroom for not being near a bedroom and split it up. We made it into a butler’s pantry with a bar for entertainment purposes and then also created a powder room and a mudroom.” Along with these improvements, they strategically placed skylights around their home to let in more natural light. All of this goes to show that an architect or designer can help make the most of your space and serve you in terms of value, helping you build equity in your home faster.

The Final Product

After a little over a year of stressful renovations, Lucas and Nick are able to look at their new home and be grateful for how far they’ve come. There is nothing better than seeing the end result of something you put so much time and money into. “Our home just works so well for us. We now have a whole floor dedicated to entertaining with more public space. We’re big hosts so we loving having dinner parties and people over. We’re able to be both outside and inside. We’ve got multiple levels of decks, a big back yard for our dogs to play. Those are the moments when I just really love the house when we can fill it with friends, family, and of course dogs.” However, their love for their home goes beyond just the house itself. They also adore their neighborhood in Logan Square. “We love how green it is. We have a park just down the street where people walk their dogs and have picnics. People fully take advantage of that almost as if it was an extension of their yard.”

When choosing the right home for you, remember that the neighborhood and area that you’re looking to buy is just as important as the home itself, so keep this in mind if you’re on the search for your dream home.

Taking advice about the home buying process from someone who’s just been there can help you prepare for your own journey. Lucas and Nick thank you for sharing your story with us and congratulations on your new beautiful home! It looks amazing!